Good Things Come in Small Packages: Why We Like Small and Mid-Cap US Stocks.

We all know that good things come in small packages. It might be the element of surprise: Almost anything could be contained in a small package. The big stuff like a car, T.V., or maybe a dog, those are all great but pretty obvious the moment you see them. Or maybe it is the fact that if someone is gifting a small item, you know it is going to be something that is big in another way. No one is going to give you a paper clip or toothbrush as an individual gift. No, it is either going to be sentimental or of high value! Well, we think small-cap stocks offer a similar type of proposition: They are full of surprises and can have a great deal of value.

Closer to the end of 2020, Peter Hodson and I, with Belco Private Capital Inc., launched the i2i Long/Short US Equity Fund, a fund focused on small and mid-cap US stocks. Naturally, being Canadian and operating in Canada, it begs the question of why US small and mid-cap (SMID-Cap) stocks in the first place? So, let’s look at some of the reasons around why we like US SMID-caps.

More Opportunities

The first reason is likely obvious but the SMID cap space in the US is multiples the size of the Canadian SMID-cap space. One of the reasons we like small and mid cap names to begin with is simply because they tend to be more under the radar and markets tend to be slower to catch on to promising companies. As an example, we count roughly 57 analysts who cover Amazon. That is 57 people whose full-time job is to know every detail about Amazon, and that’s only formal analysts, not other market participants. Meanwhile, the typical SMID-cap name tends to have somewhere around five analysts covering them. This is not unique to the US but is a general reason why we like SMID-Cap in and of itself.

The set of opportunities available in the US for SMID-caps is far larger compared to Canada. A simple way to gauge this is if we look at the US SMID-cap index, Russell 2000, compared to the Venture composite and/or TSX composite. The TSX Venture exchange has about 160 constituents within it. Only three constituents have a market-cap over $1 billion and the list gets to sub-$300 million quite quickly, with 52 names below $100 million in market-cap. The TSX ‘300’ composite ironically actually only consists of 238 companies according to Refinitiv Eikon and let’s call a SMID-cap name in Canada as sub $20 billion in market-cap. This gets us to roughly 194 companies within this index. So, using a generous scenario, let’s call the SMID-cap investable universe in Canada (excluding CSE and so on) to be about 354 companies. The Russell 2000 has about 1,975 constituents with market-caps ranging from $10 billion to $130 million. This puts the US SMID-cap space at roughly 5.5 times the size of Canadian markets. No, quantity does not mean quality, but the more rocks that there are to turnover, the more likely you are going to find a treasure.

More Growth

With a larger opportunity set in the US, it makes sense to also expect the list of high-growth companies in the US to be larger. The economy and population in the US is larger so companies operating in this area might be exposed to more growth naturally. Casting a wide net using a screen from Refinitiv Eikon, we see 1,238 companies trading in the US with an expected revenue growth rate of 15% or greater. For Canada, this list consists of 271 companies. So, there are about 4.5 times more companies that fall into the growth category in the US vs Canada.

US SMID-Caps are Cheap

We think the above picture is worth a thousand words, but it shows us the price-to-earnings ratio for mid-caps (top) and small-caps (bottom) for the last 20 years. We are using the S&P 600 and 400 as it tends to be a higher quality SMID-cap index with less noise compared to something like the Russell 2000. If you extend it out to 30 years, you get essentially the same result, which is that outside of 2008, SMID-caps have almost never been this cheap. What is particularly surprising is that for mid-caps, they are even cheaper than the valuation trough in the heart of COVID. To put this another way, mid-cap stWe think the above picture is worth a thousand words, but it shows us the price-to-earnings ratio for mid-caps (top) and small-caps (bottom) for the last 20 years. We are using the S&P 600 and 400 as it tends to be a higher quality SMID-cap index with less noise compared to something like the Russell 2000. If you extend it out to 30 years, you get essentially the same result, which is that outside of 2008, SMID-caps have almost never been this cheap. What is particularly surprising is that for mid-caps, they are even cheaper than the valuation trough in the heart of COVID. To put this another way, mid-cap stocks are cheaper now than when we were facing a global pandemic and literal global economic shutdown! Things might not be great in the world right now, but we don’t think it is controversial to say that they are not as bad as the middle of the emergence of COVID.

While mid-caps are not at trough levels for the 2008 great financial crisis (GFC), the valuations are again at least flirting with those levels. Again, while things might not be great currently, we think most would be stretching to try to draw parallels to the GFC.

SMID-caps trading at levels that investors have not seen for nearly 30 years or more is another reason we like the SMID-cap space.

US SMID-Caps are cheap relative to the alternativeocks are cheaper now than when we were facing a global pandemic and literal global economic shutdown! Things might not be great in the world right now, but we don’t think it is controversial to say that they are not as bad as the middle of the emergence of COVID.

While mid-caps are not at trough levels for the 2008 great financial crisis (GFC), the valuations are again at least flirting with those levels. Again, while things might not be great currently, we think most would be stretching to try to draw parallels to the GFC.

SMID-caps trading at levels that investors have not seen for nearly 30 years or more is another reason we like the SMID-cap space.

US SMID-Caps are cheap relative to the alternative

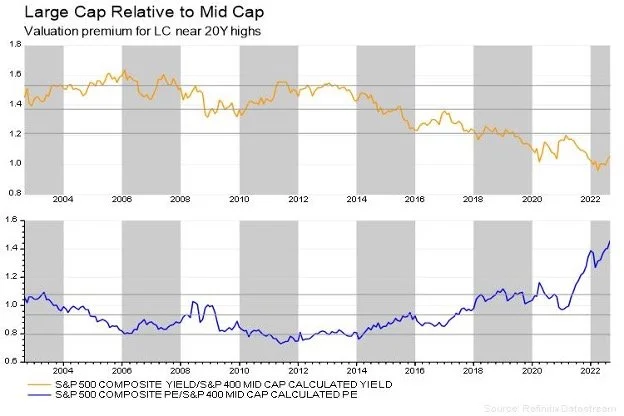

While the prior chart was self-explanatory, this one might require some preamble. Here, we are comparing large-caps (S&P 500) to mid-cap stocks based on the dividend yield (upper chart) and the P/E ratio (lower chart). For dividend yield, the higher the yield, the cheaper you might expect stocks to be. The downward sloping chart shows that relative to large-caps, mid-caps are at lows from a valuation perspective. While the lower chart is moving in a different direction, it is telling us a similar thing. A lower P/E ratio for mid-caps relative to large-caps means an upward sloping line because again, mid-caps have almost never been this cheap relative to large-caps.

We think this is a nice feather in the cap for mid-cap stocks. Not only are they cheap on an absolute basis historically, they are also cheap to your other primary option in stocks, being large-caps.

US Dollar Exposure can be a Good Hedge for Canadian Investors

For the sake of brevity, we won’t spend too much time on this point, but the US dollar (USD) tends to be a flight to safety asset. This means that when things look bad, assets flow to the US dollar and it increases relative to other currencies. In turn, for Canadian investors, in a market downturn, the USD tends to rise making assets worth a bit more in Canadian dollar terms. Over the last five years, there has been a negative correlation between the S&P 500 and the USD/CAD exchange rate of about -0.5. So, when the S&P 500 goes down, the USD tends to go up, offering a bit of a natural hedge.

These are a few reasons why we find the US SMID-Cap space so interesting and rich with opportunities while being a space that tends to be overlooked by Canadian investors. Ironically, one of the reasons we think it gets overlooked is because the opportunity set is so large, that it can be a bit overwhelming. Fear not, because just like that gift in a small-package, US SMID-Caps could be the gift that keeps on giving!

Belco Private Capital Inc. (“Belco”) is the investment fund manager, portfolio manager and exempt market dealer for the i2i Long/Short US Equity Fund. Ryan Modesto is a Portfolio Manager for the i2i Long/Short US Equity Fund and CEO of 5i Research.

Ryan Modesto has a financial or other interest in Amazon (AMZN). The i2i Long/Short US Equity Fund does not hold a financial or other interest in any securities mentioned at the time of publishing.